Not unless you’re a business paying for a health plan for your employees. For individuals, the Canada Revenue Agency (CRA) has a has a whole list of health care expenses that are eligible for the Medical Expenses Tax Credit. This tax credit is non-refundable meaning it won’t be paid out if you already don’t pay taxes but can lower your health-related spending by up to 20%.

Common health expenses you can claim include dental visits, laser eye surgery, diapers, hearing aid, and even medical cannabis. It’s important to get to know this list so you can account for all your health spending and claim it. The list is quite large.

Are Health Benefit Plan Premiums Eligible for the Tax

Credit?

Yes. Health benefit plan premiums that you pay to private

health insurance companies are eligible for the Medical Expenses Tax Credit

which is interesting because it allows for you to access this tax credit even

if you’re healthy.

When you’re most healthy is the best time to institute a private health benefits plan because insurance companies exclude pre-existing health conditions and their associated treatments (including prescription drugs) on all their best plans. You can get unlimited prescription coverage on conditions that you don’t already have but you would be limited to $2,700 prescription drug coverage limits on anything pre-existing. Health benefit plans become far less attractive when you need to cover pre-existing health conditions because the insurance providers price in the assumption that entire limits will be used.

Plans are available for those who need to cover pre-existing

conditions, but benefits limits are significantly lower, and prices are

exceedingly higher.

This tax credit is only another incentive for you to plan for what is inevitable. Life is finite and the government wants your money. The best way to deal with these inevitabilities is through planning.

How Does the Medical Expense Tax Credit Work?

Add up all your eligible health expenses for the year then

deduct it by the lower of either 3% of your net income or $2,352 (2019),

then multiply the sum by 15% plus your lowest provincial marginal tax rate.

This is how it’s calculated in the background but all you would have to provide

is the sum total of your annual eligible health expenses. This would be claimed

on lines 330 or 331 of your annual personal income tax return. Sounds

complicated? Here is a calculator to add up how much this credit would represent

for you.

Even if you haven’t started planning and you’re don’t currently have a spotless bill of health, it’s not too late. Often it will still make sense to purchase a medical plan knowing they will exclude coverage on a prescription you take because prescription drug costs vary widely. Standard blood pressure pills often cost under $20 every 3 months while some Cancer drugs cost over $4,000 per month and aren’t covered by provincial health insurance plans in any way. There’s still a wide gap of coverage by provincial health plans for those with diabetes and that condition can be debilitating financially.

Read more

Skip calling all the insurance companies for rates and plan summaries. We’ll send you a menu of all the health benefit plans from all the providers with price quotes tailored to you and your family. We’re skipping all the baloney.

Get your Tailored Health Benefits Plan Menu

What happens next?

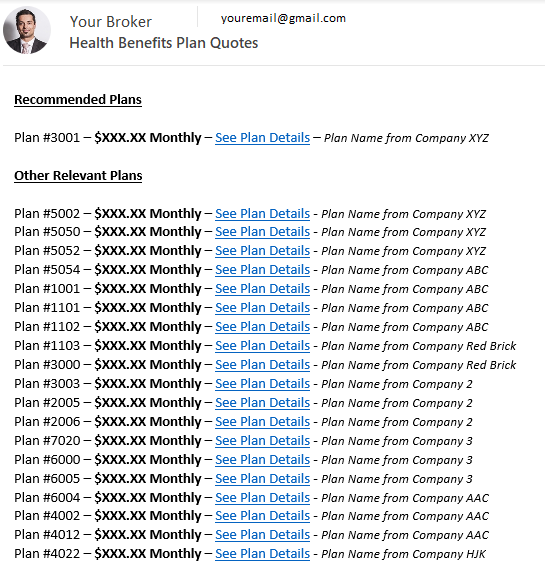

After requesting price listings, you’ll get an email within 30 minutes providing your broker’s name and contact information. There will be a disclosure in the email for the purpose of transparency, a link to their provincial license as well as their social media. You can get to know your broker as much or as little as you want.

If you request your quote during business hours, you’ll get a

menu of options from your broker within 2 hours. If your request is after

business hours, you can expect it the early the next business day. You will get

a phone call from your broker introducing themselves. If you prefer to only

communicate electronically, that’s okay, let your broker know.

Your broker will further simplify things for you by making a recommendation, but we don’t care which provider you use. We just want your business and to keep it. Let us know how we can do that.

All the plans are numbered, and the summaries are presented in a standardized way which really helps in comparing what the plans cover. If you’re looking for good massage therapy coverage, then plan #1102 can be a good option. If you need affordable major dental coverage that starts quick, plan #6005 is a good one. It can often save you money on the dental alone. To add, our service doesn’t cost you anything extra. You could go to all the insurance companies directly and it would cost you the same amount.

If you want coverage on existing medical conditions or prescription, that’s fine. We’ll send all the plans that available that don’t require a medical questionnaire. If you recently left a group benefits plan, you can get decent prescription coverage that covers existing medication. Plan #2024 is no doubt a high-end plan, but it can cover $200 a month of existing prescription expenses.

End of story.

Read more

As Canadians, we’re fortunate to have access to a public healthcare system. We hear these horror stories of people getting 4, 5 and even 6 figure medical bills in the US, dismissing that poor health can cost us our livelihood, even here in Ontario. We have good critical care but chronic illness is treated as an afterthought. Unless your condition is acute, degenerative or deadly, you have to push for public resources to engage healing. You need a referral for diagnostic tests or specialists and waiting in queues can be long.

Having a proper health benefits plan is a game changer in managing your health because it removes the main reason to delay treatment. It’s expensive to pay for medical specialists and diagnostics out of pocket. They’re not a fun expense either. I call it defensive spending because it’s to maintain your quality of life rather than improving it. If it’s the other way around then you’re likely waiting too long to deal with health issues. Kind of like a gym pass, the psychological effect of paying for preventative health services in a health plan will push you to use them which inevitably makes you healthier. People with health benefits are healthier.

Get a Health Benefits Plan Quote

In looking at health benefit plans; you want to get as much as you can for the money. To do that, you should get a plan before you need it. Health plans are way more accessible when you don’t have existing health conditions and medications that need to be covered. If you already have an issue to deal with you can still save money with a health plan but you have to choose the right one. Blue Cross health benefit plans come with a discount program called the Blue Advantage. Using a discount program is the easiest way to reduce your health spending if you’re already dealing with health issues. Blue Cross is the only insurance company offering an extensive discount program with their health benefit plans making them an ideal option.

With Blue Cross, Blue Advantage offers discounts up to 60% on lenses and frames for vision care related spending. If you choose one of their dental hygenist partners, you can access a 20% discount which can be used on top of the dental benefit you have purchased on your Blue Cross plan. Because all discounts can be used on top of existing benefits that the plan provides, the depth of savings is higher than any other plan. You just have to be flexible. There are also discounts at gyms, for physiotherapy, acupuncture, chiropractic care, spinal decompression, nutritional counseling, smoking cessation programs, senior services and a multitude of medical devices. There are more discounts than I can reasonably list.

If you already have a health issue, the Express Plan by Blue Cross will offer you a higher level of coverage for the cost than counterparts because of the Blue Advantage discount program that comes as part of the plan. Not only can the discounts be used for existing medical issues but the coverage can too (with minor exceptions). By stacking Bluecross Express Plan coverage and BlueAdvantage discounts, you can save money on health expenses over the short and long term.

Being proactive in the process of healing is the key to good health. You need to understand your ailments and have the resources to harmonize your health before issues turn into real problems. While awaiting the next OHIP covered step in your healing plan, you should educate yourself by meeting with alternative specialists. See a naturopath, speak with an osteopath, try acupuncture, speak with a psychologist, see a dietician, dive into meditation, try massage therapy, aromatherapy or lose yourself in the jungle. It’s surprising what stress can do and one person won’t have all the answers.

Remove the biggest barrier (which is money) today by getting a quote for a health benefits plan.

Read more