Get Price Listings for All Health Benefit Plans in Ontario

Skip calling all the insurance companies for rates and plan summaries. We’ll send you a menu of all the health benefit plans from all the providers with price quotes tailored to you and your family. We’re skipping all the baloney.

Get your Tailored Health Benefits Plan Menu

What happens next?

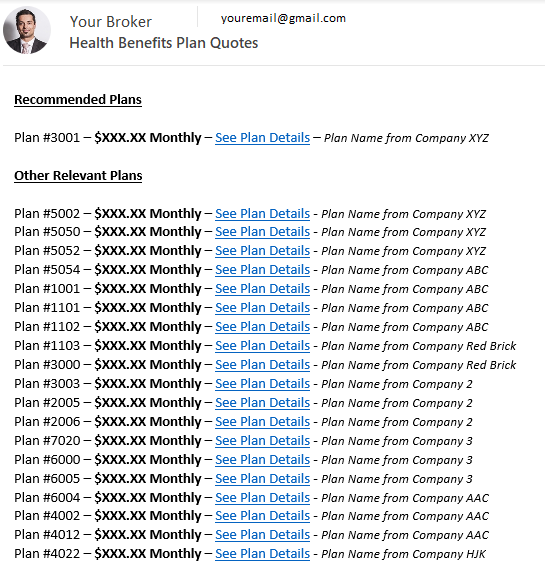

After requesting price listings, you’ll get an email within 30 minutes providing your broker’s name and contact information. There will be a disclosure in the email for the purpose of transparency, a link to their provincial license as well as their social media. You can get to know your broker as much or as little as you want.

If you request your quote during business hours, you’ll get a menu of options from your broker within 2 hours. If your request is after business hours, you can expect it the early the next business day. You will get a phone call from your broker introducing themselves. If you prefer to only communicate electronically, that’s okay, let your broker know.

Your broker will further simplify things for you by making a recommendation, but we don’t care which provider you use. We just want your business and to keep it. Let us know how we can do that.

All the plans are numbered, and the summaries are presented in a standardized way which really helps in comparing what the plans cover. If you’re looking for good massage therapy coverage, then plan #1102 can be a good option. If you need affordable major dental coverage that starts quick, plan #6005 is a good one. It can often save you money on the dental alone. To add, our service doesn’t cost you anything extra. You could go to all the insurance companies directly and it would cost you the same amount.

If you want coverage on existing medical conditions or prescription, that’s fine. We’ll send all the plans that available that don’t require a medical questionnaire. If you recently left a group benefits plan, you can get decent prescription coverage that covers existing medication. Plan #2024 is no doubt a high-end plan, but it can cover $200 a month of existing prescription expenses.

End of story.